Smarter Charitable Giving – Should You Use a Donor Advised Fund?

By Ben Yeager

While I enjoy each season here in NC, I especially love the fall. It brings cooler weather, brilliantly colored leaves, the State Fair and football almost every day of the week!!! It’s by far my favorite season of the year. The fall is also a favorite and extremely important time of the year for charities as donors make year-end gifts.

Unfortunately, last fall was not as enjoyable as many charities hoped. Gifts from individuals to charities and foundations dropped in 2018 according to a study done by Giving USA. The reason for the unusual decline is not fully clear but many believe the Tax Cuts and Jobs Act (TCJA) passed in 2017 played a part in this decline.

The Tax Foundation estimates that the percentage of individual taxpayers claiming the itemized deduction decreased from 30% to 10% in 2018. This is likely due to the larger standard deduction and new limits placed on certain itemized deductions. These changes reduced and, in some instances even eliminated, the tax savings charitable gifts would have generated for many taxpayers under previous tax law.

The good news is that, with a little planning, there are still several ways to give and take advantage of a charitable deduction. One particularly useful strategy gaining popularity under the new tax law is gifting through a Donor Advised Fund (DAF).

What’s a DAF?

Well, I’m glad you asked. A donor advised fund is an investment account to which an individual can donate cash or appreciated assets. These donations are considered charitable donations for the year they are deposited into the account (which is technically owned by a nonprofit entity). Eventually these funds must be granted to a qualified charitable organization; however, the donor can choose the timing of the grant as well as the charity or charities ultimately receiving the funds. It can help to think of it like a 401(k) plan for charitable giving.

Other benefits of using a DAF:

In most cases, it is extremely simple to make grants from a DAF – the platform that we use for our clients typically requires just a few clicks to give money from the account.

If a donor is making charitable gifts to a number of charities, the tax reporting of gifts becomes much simpler if a DAF is used – the taxpayer needs to provide the IRS only with the confirmation of the sum contributed to a DAF. All of the subsequent grants to charities are not reported.

Some donors find that a DAF helps them to think separately about the tax planning and charitable planning components of charitable giving. The amount and timing of a donation involve financial planning around the tax strategy; but choosing a charitable recipient can require a very different mindset. With a DAF, the account has already been funded and the donor can give money to any charity at any time they choose.

What are some strategies using Donor Advised Funds?

Traditionally (i.e. before the recent tax law changes) the most common use of a Donor Advised Fund was in situations when the donor was expecting a high-income tax year and wished to maximize their deductions in that year. This charitably inclined taxpayer would gift several years’ of expected future gifts to a DAF, take the full deduction that year, and then grant out the assets to the charities over several years.

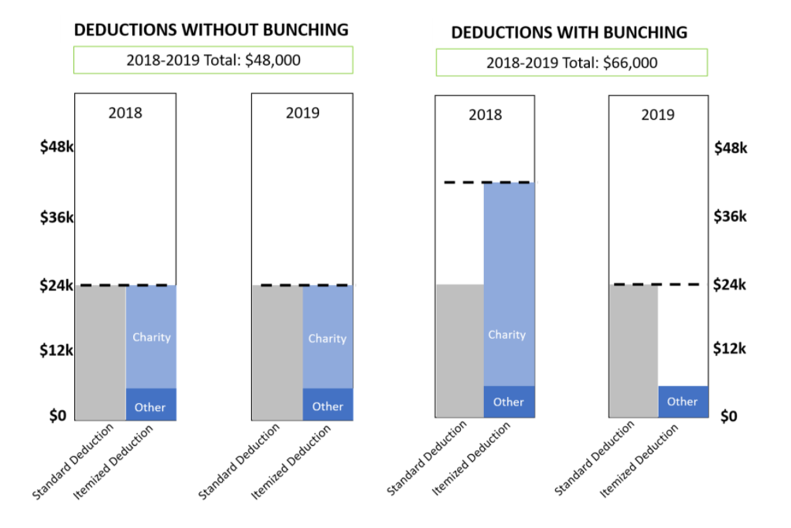

But it is a related strategy known as “bunching” that has made Donor Advised Funds so popular since the tax law change. Bunching is used for those who like to gift yearly but don’t gift enough to itemize their deductions and therefore receive no tax benefit from their gifts. By donating 2 or more years’ worth of gifts to a DAF the donor increases their total charitable deduction so that it is greater than the standard deduction that year. Then in subsequent years, the donor makes grants to their charities – these grants do not bestow any itemized deductions, so the donor takes the standard deduction. Utilizing this multiyear strategy would enable many taxpayers to significantly increase their deductions.

For more details, see the Hilltop Views post “Bunching Your Charitable Gifts Could Save You on Taxes - Decoding the Tax Law”.

Lastly, the benefits of all these strategies can be compounded when gifting appreciated assets instead of cash to a DAF. The capital gain associated with appreciated assets transfers to the DAF and thus is not realized by the donor. The DAF can then sell the assets tax free. Assets such as common stock, real estate, and even privately held business interests can be donated to a DAF.

If you will be selling your business in a few years, talk to an advisor before you contract to sell the business. You may be able to gift a portion of the business to a DAF before the sale and avoid some of the likely large capital gains.

As you can see, there are still many ways to qualify for a tax deduction on your charitable gifts. While gifting is not just about the tax deduction, doing a little planning and using the right strategy can allow you to make a difference and save on taxes at the same time.

Hilltop is committed to helping our clients make wise financial decisions and positively impacting the world around us. It’s not just something we like to say, it’s who we are. If you would like to learn more about these strategies or Hilltop, we’d love to talk.

Sources:

https://www.philanthropy.com/article/Gifts-to-Charity-Dropped-17/246511

https://taxfoundation.org/2018-tax-return-data/

https://www.irs.gov/statistics/filing-season-statistics?mod=article_inline

DAF Flowchart: https://www.kitces.com/blog/rules-strategies-and-tactics-when-using-donor-advised-funds-for-charitable-giving/

Disclaimer:

This material is provided as a courtesy and for educational purposes only. Hilltop Wealth Advisors does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state laws are complex and constantly changing. You should always consult your own legal or tax professional for information concerning your individual situation.